The insurer’s confession to a judgment and tendering the amount to the insured did not in of itself create the judgment needed to bring finality to the dispute. That had not even been done in this case.

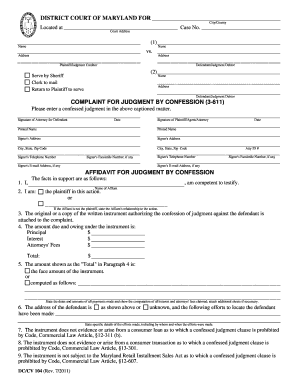

CONFESSION OF JUDGMENT TRIAL

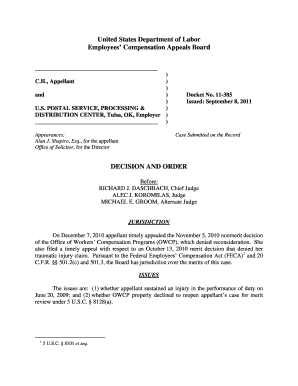

The thirty-day clock to file the motion for attorney’s fees did not begin until the trial court entered a judgment. While voluntary payment of claim may have triggered entitlement to statutory attorney’s fees, subsequent unilateral action of filing its Confession Filing did not “conclude the action” so as to trigger rule 1.525’s thirty-day time period. Rule 1.525’s thirty-day time period commences upon the trial court’s rendition of a judgment, or service of a notice of voluntary dismissal, that concludes the action as to the party seeking fees. Simply put, a “confession of judgment” in the context of section 627.428 is not the functional equivalent of the “judgment” that opens the thirty-day filing window prescribed in rule 1.525. The Third District Court of Appeal explained: 627.428 provides an entitlement to attorney’s fees upon the rendition of a judgment. A judgment needs to be signed by a judge and bring finality to the dispute. Rule 1.525 starts the 30-day clock from the actual judgment. The trial court agreed and struck the insured’s motion for attorney’s fees.īut here lied the problem. The insurer moved to strike the motion for attorney’s fees for being filed outside of the 30-day window required by Florida Rule of Civil Procedure 1.525. Well outside of 30 days from the filing of this Confession of Judgment, the insured filed a motion for attorney’s fees. The insurer did so by filing a “Confession of Judgment and Confession of Coverage” in the trial court. This amount was also tendered to the insured.

CONFESSION OF JUDGMENT PLUS

The insurer, recognizing there was coverage, consented or confessed to the entry of a judgment in an amount that included the insured’s principal damages plus prejudgment interest. 3d DCA 2021), an insured filed an insurance coverage dispute against her first-party insurer. 627.428 provides: “ Upon the rendition of a judgment or decree by any of the courts of this state against an insurer and in favor of any named or omnibus insured…under a policy or contract executed by the insurer, the trial court or, in the event of an appeal in which the insured or beneficiary prevails, the appellate court shall adjudge or decree against the insurer and in favor of the insured or beneficiary a reasonable sum as fees or compensation for the insured’s or beneficiary’s attorney prosecuting the suit in which the recovery is had.”

In an insurance coverage action, Florida Statute s. The latter is the scenario in the insurance coverage case discussed below.įlorida Rule of Civil Procedure 1.525 provides: “ Any party seeking a judgment taxing costs, attorneys’ fees, or both shall serve a motion no later than 30 days after filing of the judgment, including a judgment of dismissal, or the service of a notice of voluntary dismissal, which judgment or notice concludes the action as to that party.” Even though Florida has a statute which, on its face, prohibits the enforcement of confessions of judgment, out-of-state creditors have been cleverly utilizing this device against Florida business owners for years.There are times a party rightfully moves to strike another party’s motion for attorney’s fees for being untimely. There are other times a party may try to create a “gotcha” moment to catch a party off guard to create a strategic argument that the motion for attorney’s fees was untimely. Yet it exists as recognized by numerous states across the country including New York. In states like New York, in which confessions of judgment are recognized, a creditor may proceed directly to the Clerk of the Court and, based upon an affidavit alone, have a judgment entered against a debtor who is alleged to be in default.Īt first blush, this procedure would appear to violate every possible notion of due process. A confession of judgment is basically a contract provision which allows a creditor to enter a judgment against a debtor without the need to file a complaint or to conduct a trial. One reason for this may be because the use of confessions of judgment, by lenders, is prohibited by Florida statute.

To the average Floridian, the term “confession of judgment” is likely to be unfamiliar.

0 kommentar(er)

0 kommentar(er)